Analysts Discuss the Outlook for the Global IT Market During Gartner IT Symposium/Xpo 2020 Americas, October 19-22

Bangkok, Thailand, November 5, 2020— Worldwide IT spending is projected to total $3.8 trillion in 2021, an increase of 4% from 2020, according to the latest forecast by Gartner, Inc. IT spending in 2020 is expected to total $3.6 trillion, down 5.4% from 2019.

Analysts discussed the outlook for the global IT market during Gartner IT Symposium/Xpo Americas, which is taking place virtually through Thursday.

“In the 25 years that Gartner has been forecasting IT spending, never has there been a market with this much volatility,” said John-David Lovelock, distinguished research vice president at Gartner. “While there have been unique stressors imposed on all industries as the ongoing pandemic unfolds, the enterprises that were already more digital going into the crisis are doing better and will continue to thrive going into 2021.”

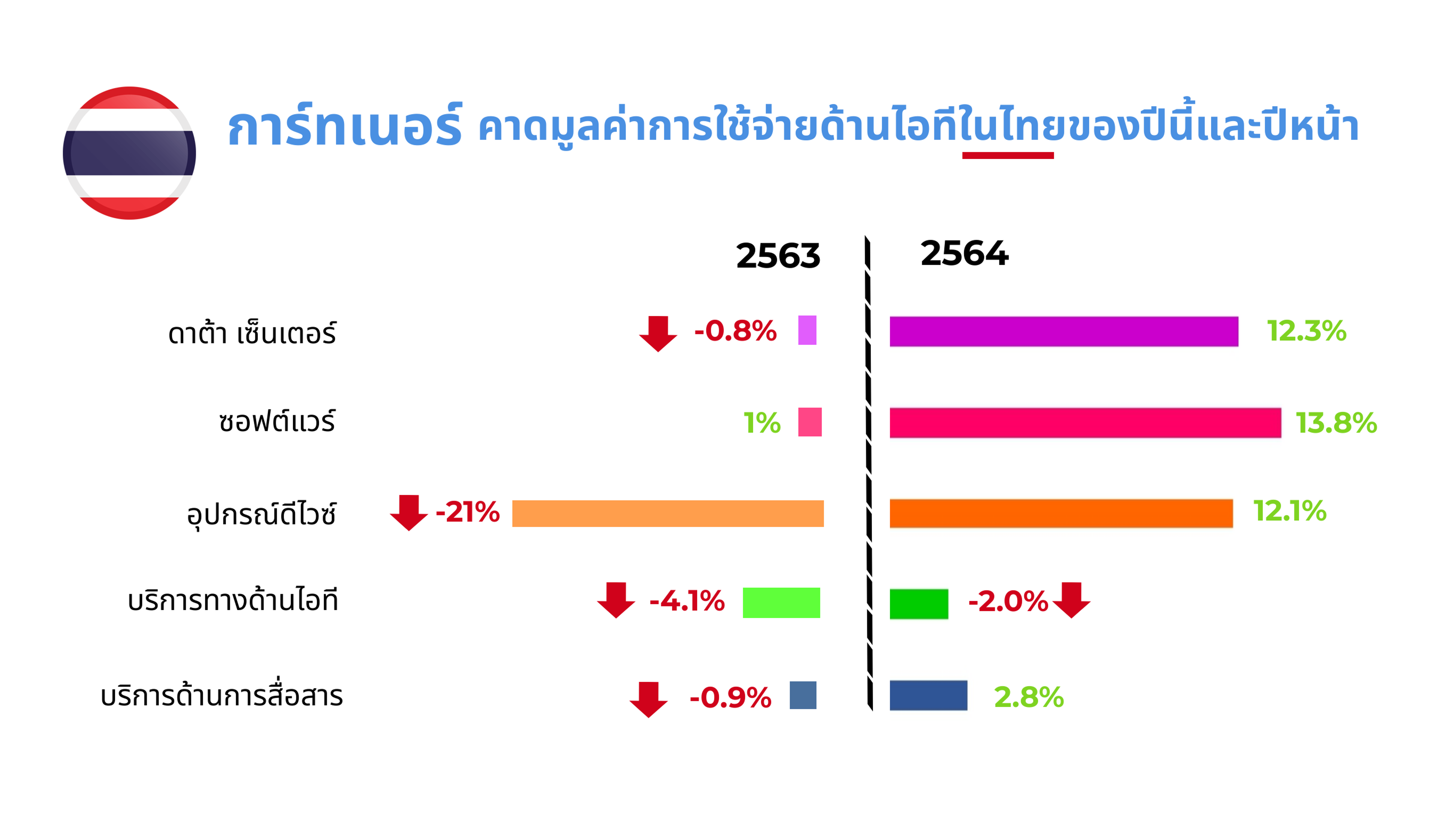

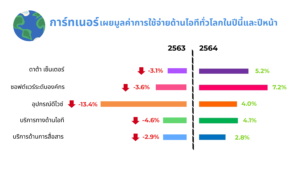

All IT spending segments are forecast to decline in 2020 (see Table 1). Enterprise software is expected to have the strongest rebound in 2021 (7.2%) due to the acceleration of digitalization efforts by enterprises supporting a remote workforce, delivering virtual services such as distance learning or telehealth, and leveraging hyperautomation to ensure pandemic-driven demands are met.

Table 1. Worldwide IT Spending Forecast (Millions of U.S. Dollars)

| 2019 Spending | 2019 Growth (%) | 2020 Spending | 2020 Growth (%) | 2021 Spending | 2021 Growth (%) | |

| Data Center Systems | 214,911 | 1.0 | 208,292 | -3.1 | 219,086 | 5.2 |

| Enterprise Software | 476,686 | 11.7 | 459,297 | -3.6 | 492,440 | 7.2 |

| Devices | 711,525 | -0.3 | 616,284 | -13.4 | 640,726 | 4.0 |

| IT Services | 1,040,263 | 4.8 | 992,093 | -4.6 | 1,032,912 | 4.1 |

| Communications Services | 1,372,938 | -0.6 | 1,332,795 | -2.9 | 1,369,652 | 2.8 |

| Overall IT | 3,816,322 | 2.4 | 3,608,761 | -5.4 | 3,754,816 | 4.0 |

Source: Gartner (October 2020)

Spending on data center systems will experience the second highest of growth of 5.2% in 2021 as hyperscalers accelerate global data center build out and regular organizations resume data center expansion plans and allow staff to be physically back onsite.

Despite the increase in cloud activity in 2020 as organizations shifted to a remote-work-first environment, enterprise cloud spending – which falls into multiple categories – will not be reflected in vendors’ revenue until 2021.

“The spending slowdown that took place from roughly April through August of this year, coupled with cloud service providers’ ‘try before you buy’ programs, is shifting cloud revenue out of 2020,” said Mr. Lovelock. “Cloud had a proof point this year — it worked throughout the pandemic, it scaled up and it scaled down. This proof point will allow for accelerated penetration of cloud through 2022.”

“With revenue uncertainty promoting cash from being King to being Emperor, CIOs are now prioritizing IT projects where the time to value is lowest,” said Mr. Lovelock.

“Companies have more IT to do and less money to do it, so they are pulling money out of the areas they can afford, such as mobile phone and printer refreshes, which is why there will be less growth in the devices and communications services segments,” added Mr. Lovelock. “Instead, CIOs are spending more in areas that will accelerate their digital business, such as IaaS or customer relationship management software.”

Moving forward, digital transformation will not be subject to the same ROI justification it was pre-pandemic as the mandate for IT becomes business survival, rather than growth.

More detailed analysis on the outlook for global IT spending is available in the Gartner webinar ‘IT Spending Forecast, 3Q20: Technology Trends Accelerated by COVID.”

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of sales by thousands of vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

The Gartner quarterly IT spending forecast delivers a unique perspective on IT spending across the hardware, software, IT services and telecommunications segments. These reports help Gartner clients understand market opportunities and challenges. The most recent IT spending forecast research is available to Gartner clients in “Gartner Market Databook, 3Q20 Update.” This quarterly IT spending forecast page includes links to the latest IT spending reports, webinars, blog posts and press releases.

About Gartner IT Symposium/Xpo

Gartner IT Symposium/Xpo 2020 is the world’s most important gathering for CIOs and other IT executives. IT executives rely on these conferences to gain insight into how their organizations can use IT to overcome business challenges and improve operational efficiency. Follow news, photos and video coming from Gartner IT Symposium/Xpo on Smarter With Gartner, on Twitter using #GartnerSYM, Instagram, Facebook and LinkedIn.

Upcoming dates and locations for Gartner IT Symposium/Xpo include:

October 27-29| APAC| Virtual

November 9-12| EMEA| Virtual

November 17-19| Japan| Virtual

November 23-25| India| Virtual

About Gartner

Gartner, Inc. (NYSE: IT) is the world’s leading research and advisory company and a member of the S&P 500. We equip business leaders with indispensable insights, advice and tools to achieve their mission-critical priorities and build the successful organizations of tomorrow.

Our unmatched combination of expert-led, practitioner-sourced and data-driven research steers clients toward the right decisions on the issues that matter most. We are a trusted advisor and an objective resource for more than 14,000 organizations in more than 100 countries — across all major functions, in every industry and organization size.

To learn more about how we help decision makers fuel the future of business, visit gartner.com.